Wildcat: Banking but Better

Understanding Wildcat as one of the last missing piece of DeFi

Many people believe that Crypto will slowly change the nature of capital markets. While the 2016-2020 period in crypto can be vaguely characterised as an aimless exploration of smart-contract platforms to explore PMF, the DeFi summer of 2020 changed things.

Since the beginning of DeFi summer, we have turbo-run/experimented with various arcs of off-chain finance and learnt several lessons. Most of these experiments were cheap imitations of off-chain finance. We saw the rise and fall of pool-2 farming, Lending protocols, Decentralized exchanges, Perpetual exchanges, Liquidity bonding protocols, Index funds, and more. We also saw several iterations of algorithmic stablecoins, which, in some sense, always broke due to the excess leverage embedded in their system, akin to some of the meltdowns in the financial world. Today, in the decentralized onchain world, only a few of these original protocols survive and have become crucial to the DeFi ecosystem. We can bucket these protocols in several micro granular buckets and abstractions. Still, broadly speaking, the ones that have survived and/or currently thriving are decentralized exchanges, lending protocols, yield trading protocols, perpetual exchanges, and RWA protocols. This is not a comprehensive list by any means, but it broadly covers all grounds.

DeFi has slowly matured, making systems more efficient. While many have repeated these words, a vision of crypto was banking the unbanked, democratizing access to financial instruments and building the future of France compared to the archaic, slow and rigid system of the current financial world. Talking about the DeFi Renaissance and the second coming of crypto’s original PMF is an undertaking that merits its own article. In this blog, we will be talking about something else.

While we have grown the pie since the early DeFi summer days, there are still many key pieces missing from this story to make it a complete alternative to the financial world.

One core piece that has always been missing from the DeFi landscape is undercollateralized lending. I thought undercollateralized lending would be explored in the coming years in my lists from early 2022 and early 2023 on open problems in DeFi and Crypto. What makes it difficult is, ultimately, an entity is represented as an address onchain. This is all the information you have about its existence. They may have multiple wallets, but none of this adds any helpful information about their credit health. To develop a credit history in the real world, you usually use credit cards often, repay dues on time to get a credit score ascribed to you, and do similar things with borrowing-repayment activities. You are eligible for loans when you have a credit score above a certain level. Better credit scores lead to better loan terms, but they are not fully secured and can be secured by a part of the loan. Undercollateralized loan systems are the heartbeat of the financial world, and when you look at it through that lens, credit is the heartbeat of the modern capital world.

The protocol name from my second list, Wildcat Protocol, is what we will discuss in this blog. I will try to give a brief overview of the protocol itself, its structure, and the various things it allows its users to do. However, around and after this exploration, I would like to weave in the importance of Private credit markets for ecosystems, how they’ve grown and become critical indicators of market health in financial ecosystems, why undercollateralized lending has been challenging, and how Wildcat took a thoughtful yet obvious-in-hindsight approach to bring this instrument on-chain. With Wildcat, we close a loop on DeFi as a decentralized mechanism that utilises blockchains as coordination tools for financial capital among various off-chain parties. In short, it lays the foundation for decentralized finance. Future protocols will be advancements of these building blocks, already seen as order books make their way to on-chain Dexes, better lending markets of different flavours in the form of Morpho and Euler, etc. Future protocols will either be in the spirit of making things more efficient for the base protocol, unlocking more users by making usage seamless with better/advanced UX, or reinventing some of these core cogs in the DeFi machinery with a different lens.

The Allure of Credit: From tradfi to crypto

Before we delve into Wildcat, pondering the nature of credit is worth considering. Credit is more than just financial plumbing; it's often the invisible hand guiding market sentiment, a powerful indicator of where we stand in the economic cycle. Its expansion fuels booms, inflating asset prices and fostering a collective belief in perpetual motion. Its sudden and sharp contraction signals the hangover, the brutal return to reality. As seen below, something different about this cycle till now has been the absence of credit, which has essentially been credit-starved, which can also be seen in the severe contraction of the Alt market and the expansion of bitcoin dominance in crypto. When credit flows freely, markets soar; when it dries up, they crater, especially when funding smaller parts of the market.

This isn't a new phenomenon. History is filled with examples. The South Sea Bubble, the railway manias of the 19th century, the Roaring Twenties, the dot-com bubble, and the 2008 Global Financial Crisis all bear the fingerprints of credit excess. In the book Devil Takes the Hindmost, the author notes about the 1822-1825 credit cycle: “The boom of 1822-25 can be understood as the product of easy credit conditions; During the boom the restricted growth of credit caused asset prices to rise, stimulating further credit creation”. During credit cycles, "people become convinced the prosperity will last forever". Declining yields on traditional safe assets and excess capital can make speculative ventures seem particularly attractive.

The ascent of private credit from a niche market segment to a significant force in the financial ecosystem has been a defining trend, particularly in the years following the Global Financial Crisis (GFC). Initially, the growth was primarily a response to a shifting regulatory landscape. Post-GFC regulations (like Dodd-Frank and Basel III) imposed stricter capital requirements and risk aversion on traditional banks. This led banks to curtail lending to specific segments, particularly middle-market companies and more complex or esoteric credits, creating a substantial funding gap. This created a vacuum, a "mismatch of supply and demand," where private credit providers stepped in to fill the financing gap. The persistent low-interest-rate environment following the Global Financial Crisis (GFC) also played a crucial role, compelling institutional investors, such as pension funds and insurers, to seek higher yields, which private credit, often with its floating-rate structures, could offer. Private credit funds stepped in to fill this void, offering an alternative source of capital for businesses that found it increasingly difficult to secure financing through conventional banking channels.

Today, private credit is recognized as a cornerstone of the modern financial ecosystem, not merely as an alternative but as an essential component of capital provision. Its importance stems from its role in financing a significant segment of the economy that might otherwise struggle for adequate funding. For investors, it offers the potential for attractive risk-adjusted returns, portfolio diversification, and current income, often with floating rates that provide a hedge against rising interest rates. Regulatory shifts continue to create opportunities for private credit to expand into new areas as banks step away from certain types of lending, further cementing their role in the financial landscape.

Private credit funds operate with less regulatory oversight and offer bespoke, flexible terms. The market evolved into a multi-trillion-dollar force, driven by institutional investors seeking higher yields in a low-interest-rate environment. However, this growth came with inherent risks, many of which stemmed from the market's opacity. Valuing private assets is challenging, often relying on less frequent, more subjective models, which can obscure underlying volatility and delay the recognition of losses. This lack of transparency means systemic risks can build up unnoticed until a shock exposes the vulnerabilities.

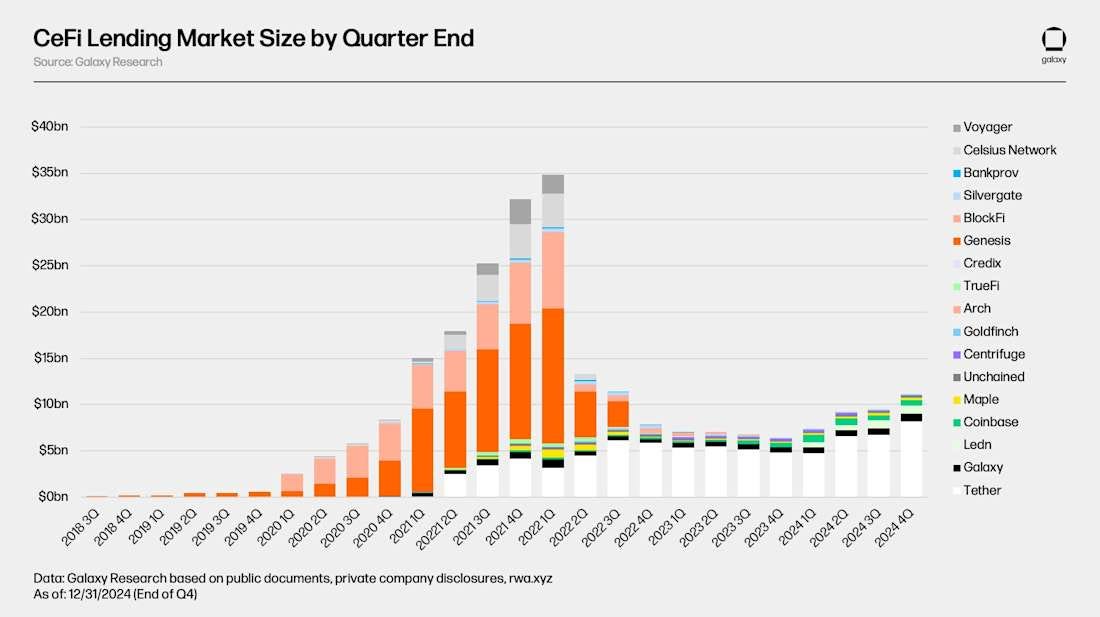

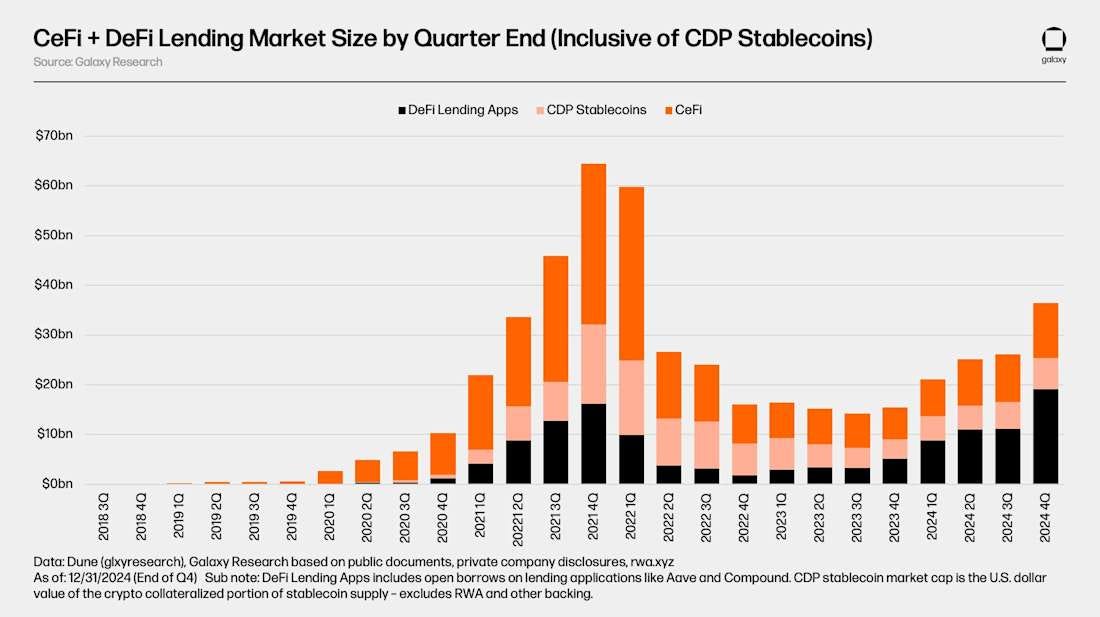

Crypto's recent history provides a hyper-accelerated version of these credit cycles. The CeFi lending boom saw platforms like Celsius, BlockFi, and Genesis become titans, their loan books swelling in lockstep with soaring crypto valuations. At its peak, the combined CeFi and DeFi lending market was valued at over $64 billion. But much of this growth was fueled by practices like massive unsecured loans, rampant asset-liability mismatches, and the acceptance of increasingly esoteric and illiquid collateral. The lack of transparency was staggering; the extent of leverage and interconnectedness across these CeFi giants was largely unknown until they began to topple like dominoes in 2022. The collapse of Terra/Luna, followed by the failures of 3AC, Voyager, Celsius, BlockFi, and Genesis, wiped out tens of billions in value and revealed a system riddled with unsustainable risk. The very entities that marketed themselves as the sophisticated bridge between traditional finance and crypto were often operating with less prudence than a casino. For more, refer to Galaxy Research’s “The state of crypto lending”.

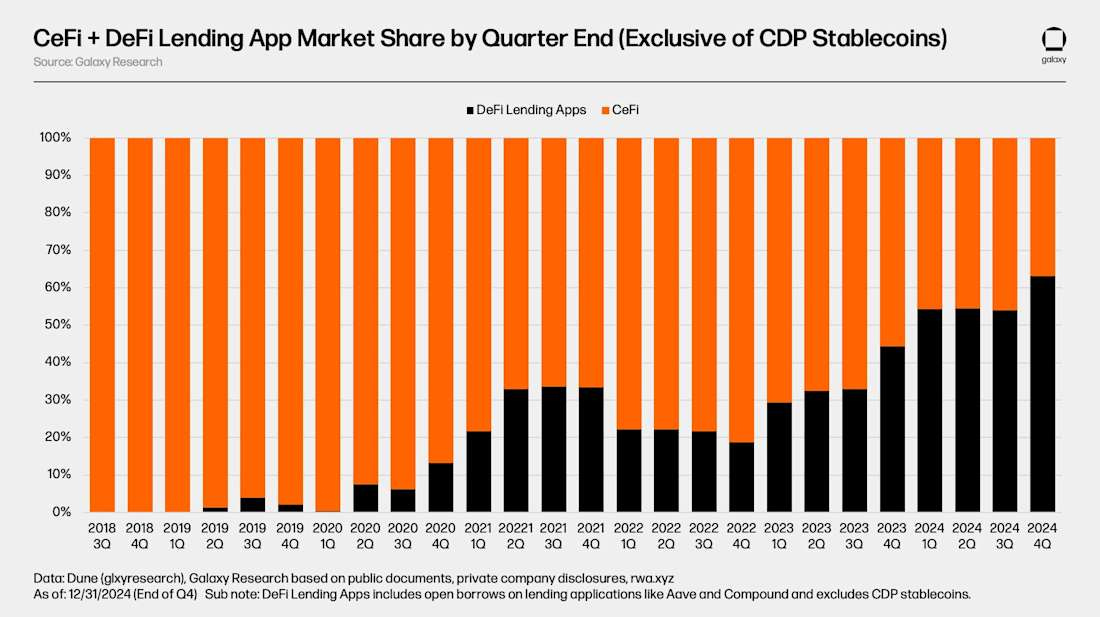

The story of lending onchain is a story of growth. Looking at the following two charts together, it is evident that DeFi lending has ushered into a bigger cycle and is growing, taking over the share/heavy lifting of the role of CeFi lending in a post-FTX world. However, DeFi lending is essentially overcollateralized, so the crypto world still suffers from a credit crunch.

Wildcat: The Protocol

Against this backdrop of opaque CeFi meltdowns and the inherent limitations of purely pseudonymous DeFi, Wildcat emerges.

Today, Credit in crypto is not managed openly. If you have the connections and ability to form deals, you might be able to strike some over-the-counter (OTC) deals in Telegram channels, through private deals, etc. There are no longer credit lines like those that existed in the previous cycle. Wildcat is ultimately an attempt to bring them into the open, on-chain, and let this transparency also support and bolster confidence in investors, sparking a new crypto credit cycle, one that we can see.

Note: I refer to the Wildcat Protocol V2 whenever mentioned in this article.

As I mentioned, facilitating undercollateralized loans in the onchain world is difficult, exacerbated by anonymity and the general lack of trustworthy information. While explorations into ZK-proofs of identity or credit scores are slowly emerging, there's another way to approach this: by focusing on institutions. Institutions operate on a different spectrum of trustworthiness compared to the challenge of assessing an individual, anonymous address. They are typically incorporated entities, allowing for basic legal contracts to be written and memorialized onchain, underpinning the legality of any arrangement. While bankruptcy remains a distinct possibility, pursuing recourse for fraud is potentially more straightforward. This institutional focus offers a middle ground between traditional finance's opaque, audit-reliant systems and the fully transparent but often overcollateralized nature of existing onchain loans. Businesses constantly seek capital to expand, become more efficient, and find alternative credit lines, and there's a corresponding supply of lenders looking to diversify and achieve specific return profiles.

The failures in the crypto space over the last few years, particularly the collapse of several centralized finance businesses often mired in fraudulent practices, underscore the need for alternatives. While onchain systems are not a panacea, if someone is determined to commit fraud, they will do so; they can offer an additional layer of defence. Transparency can help identify issues before they escalate catastrophically. We've often viewed crypto protocols as mere facilitators, but at their core, they are also powerful coordination tools. They can help solve the discoverability problem: where does capital demand meet capital supply? Wildcat steps directly into this, aiming to make on-chain credit more transparent, accessible, and, crucially, customizable.

Observing Wildcat's mechanics, its approach facilitates direct credit relationships between identifiable, KYB-verified business entities and their lenders, using Ethereum as a transparent settlement and coordination layer. This isn't about anonymous lending pools; it's about enabling specific, documented credit lines where the terms are explicit, and all activity is recorded onchain. One might then consider this structure: in practice, it begins to resemble a marketplace for something akin to liquid bonds, with the distinction that the debt instruments are formed through deposits into these onchain vaults. It also becomes a tool to mitigate the daily operational complexities of managing their existing credit lines.

It's crucial to understand that Wildcat facilitates undercollateralized credit. This means lenders are directly exposed to counterparty risk. While the protocol provides lender protections like penalty APRs for delinquent borrowers and clear mechanisms for managing withdrawals (even if they exceed reserves, using a pro-rata system and a queue), it does not underwrite any loans or shield against defaults. It functions primarily as middleware that coordinates and facilitates these loans. The inherent risk of default often justifies the potential for higher returns.

The power of Wildcat lies in the extensive control it gives borrowers. They can define nearly every aspect of their credit markets: the asset they wish to borrow, capacity, interest and penalty rates, reserve ratios, withdrawal cycle lengths, minimum deposit amounts, whether the debt tokens are transferable, and lockup durations. Borrowers can also manage their markets, adjust parameters (with some protections for lenders, like constraints on APR reduction), and eventually close them by repaying all debt.

This profound customization is made possible by the pre-transaction hook system. Think of hooks as customizable security checkpoints that borrowers can set up at the entrance to their lending markets. More technically, these are tiny, programmable "yes/no" gatekeepers that run checks before any core market action, like a deposit, withdrawal, APR change, or token transfer, hits the main contract. Borrowers select hook templates (covering access control, fixed terms, minimum deposits, or transfer restrictions) from an approved library. When a market is deployed, the "Hook Factory" clones these templates into immutable "hook instances" specifically bound to that market. These instances can enforce various conditions, from a simple OFAC check to requiring a zero-knowledge proof of off-chain revenue, all without bloating the base market contract. Lenders, in turn, can see exactly which hooks guard a market and decide if the baked-in rules suit their risk appetite.

To put it simply, pre-transaction hooks are:

Defined by Borrowers: The creators of the credit market set these rules.

Varied in Complexity: They can be straightforward (e.g., checking a sanctions list) or more intricate (e.g., verifying possession of a specific soulbound token or membership in an approved lender list via a Merkle tree).

Purposeful: They grant borrowers granular control over who can lend to them and under what conditions, effectively gating access or extending the market's functionality before any funds move or core actions are taken.

For lenders, Wildcat aims to offer choice and transparency. Once a lender obtains the necessary credentials for a market (which can be configured by the borrower to be anything from open access to highly restrictive), the interaction resembles that of a standard DeFi vault. They can assess the terms various borrowers offer—market makers, crypto banking startups, hedge funds, and DAOs. Lenders can simply choose to lend to someone else if the terms aren't suitable or if a borrower seems too opaque or risky (a critical consideration in a post-FTX world). Wildcat plans to support this with borrower profiles for disclosure and template loan agreements to provide legal recourse in default scenarios. While debt tokens issued by markets are generally tradable on secondary markets, borrowers can also restrict this if needed.

The range of potential borrowers is broad. Market makers and hedge funds are obvious candidates, as are DAOs and protocol foundations. Today, foundations often raise money through token sales, which can be locked for years or create immediate selling pressure on their asset. As onchain protocols mature and find sustainable revenue streams, an alternative form of credit, where funds are lent at a decided-upon interest rate, will be a game-changer. For instance, if a successful protocol like Hyperliquid decided to raise funds for development through, say, 14% interest vaults on Wildcat, one can imagine significant interest.

It's possible to view undercollateralized lending as contrary to DeFi's "don't trust, verify" ethos. However, as protocols mature, exploring possibilities and pushing constraints is vital. DeFi is not just about transposing the traditional financial world onto a blockchain; it's also about democratizing access to these powerful instruments. Frankly, what is more decentralized than opening up mass access to one of the most essential components of an economy? Wildcat creates infrastructure by bringing credit relationships on-chain with transparent terms, automatic enforcement mechanisms (within the protocol's logic), and democratized access. In this system, credit can flow more efficiently through digital currency networks. Whether this represents DeFi's natural evolution or a hybrid approach blending traditional finance with blockchain benefits is for the market to decide. Ultimately, Wildcat is implemented in a way that allows for extensions, including ZK proofs of assets or reserves on the borrower side, making the protocol more straightforward and, in a sense, future-proofing itself to benefit from technological advancements.

The vision for Wildcat extends beyond serving existing DeFi users. It's about opening up access to a vital part of the economy for everyone to access. In the future, as tokenization becomes more widespread and more individuals and businesses participate in the decentralized financial economy, it's conceivable that even a local bakery with access to tokenized euros could crowdfund and manage a credit line on-chain with minimal friction, backed by off-chain legal agreements. It’s about leveraging the transparency and efficiency of blockchain to build a more open and accessible credit system for everyone. Additionally, the ECB notes that opaqueness and strong growth in private markets may give rise to financial stability risks. Valuation of businesses can be a murky art, with assets marked to market less frequently and under more subjective assumptions, potentially concealing losses and actual volatility. Crypto offers a transparent alternative, and as ZK-based financial auditing grows, it will probably become the standard. The only way to participate in private credit.

Against Wildcat: Challenges for Onchain Undercollateralized Credit

The path is not without significant hurdles. Scepticism is warranted.

The core challenge remains: how do lenders accurately assess the creditworthiness of borrowers, even KYB'd ones, in a space still wrestling with information gaps? For all their size, traditional private credit markets face similar issues of opaqueness. Crypto's past is riddled with platforms that faced difficulties when their borrowers (often SMEs or entities in emerging markets) defaulted. Wildcat's reliance on borrower disclosure, template legal agreements, and the potential future integration of ZK-proofs for financial data takes the right direction. However, building true, verifiable creditworthiness onchain is an ongoing endeavour.

Another significant challenge lies in the transparency and potential for manipulation within on-chain lending platforms. While on-chain data offers some visibility, it doesn't always paint a complete picture. For instance, borrowing volumes (and thus perceived platform success or Total Value Locked) can be artificially inflated if borrowers use self-lending loops, repeatedly depositing and borrowing the same capital. While Wildcat aims to provide detailed transaction histories to expose such behaviour, the initial allure of high, albeit manipulated, volumes can be misleading. Furthermore, the on-chain nature of these protocols doesn't inherently solve the problem of off-chain opacity. The complex, often private, trading strategies and asset/liability structures of large institutional borrowers (like the former 3AC) would largely remain hidden, meaning the protocol might not, on its own, prevent collapses stemming from undisclosed off-chain risks.

I think that’s the ultimate question, would wildcat have stopped 3AC? Unlikely to prevent determined fraud. But it could have made their demise less of a black swan. 3AC’s downfall was exacerbated by the opacity of their borrowings. Had their credit lines been on Wildcat, the terms, repayment schedules, and any defaults or refinancing struggles would have been onchain data points, providing earlier stress signals. Wildcat does not mitigate fraud or avoid it, but given the transparent nature of the protocol and onchain transactions, every transaction would have added more information than was otherwise available. Making debt tokens transferable could also allow for quicker price discovery of distressed assets. The 3AC AUM letter was a prime example of how little real information was available.

Additional challenges include the complexities of cross-jurisdictional legal enforcement—what happens when a borrower in one country defaults on lenders spread across multiple jurisdictions? The reliability of KYB processes also varies significantly, and sophisticated bad actors might find ways to appear legitimate. There's also the risk of borrower collusion, where multiple seemingly independent entities could coordinate to extract value from lenders.

Conclusion

Credit is a fundamental part of our financial world, from home mortgages to business loans. It’s everywhere. On-chain credit also exists in cryptocurrency, but it often operates behind the scenes—through private deals, exchange-specific services, or opaque OTC arrangements. It’s time to give it some limelight, and Wildcat is an attempt to do justice to it.

The key is building systems that foster transparency, allow for granular risk management, and provide clear avenues for recourse while enabling the essential flow of capital that drives innovation and growth. The shift from public to private markets in TradFi and the parallel universe of crypto's often-opaque dealings point to the need for better infrastructure.

Wildcat is not a silver bullet. It won't eliminate risk or single-handedly prevent the next market downturn. It offers sophisticated, transparent, and customizable tools for institutional credit to operate onchain. Allowing borrowers to define their terms and lenders to make informed choices aims to create a more efficient and discoverable market for debt.

In traditional finance, the behaviour of private credit markets, particularly credit spreads and the sheer volume of capital flowing into them, has become a vital barometer of broader market health and investor sentiment. When credit spreads tighten, it signals growing confidence, a willingness to embrace risk, and generally looser lending conditions, often preceding or accompanying economic expansion. Conversely, widening spreads and a pullback in private credit availability indicate rising fear, a flight to quality, and a tightening of financial conditions that can foreshadow economic slowdowns or heightened default risk. The sheer volume of capital flowing into and out of private credit and the terms at which it is offered thus provide valuable insights into the underlying strength of businesses and the prevailing sentiment among institutional investors, often acting as a leading indicator for conditions that will eventually surface in more visible public markets.

This dynamic mirrors the crypto world; the explosive growth of often opaque CeFi lending during crypto bull runs, with its aggressive terms and leverage, directly reflected a period of extreme risk appetite. The subsequent deleveraging and credit contraction during downturns, alongside fluctuating borrowing rates and liquidity on DeFi platforms, similarly act as potent indicators of crypto market health, investor confidence, and the overall availability of speculative capital within the digital asset ecosystem. The challenge and opportunity in crypto credit lies in enhancing the transparency of these flows so they can serve as clearer, more reliable signals for the entire market. And I think Wildcat is the right step in this direction.

The journey of DeFi has been one of rapid experimentation, often mirroring the trial-and-error of financial history, but at an accelerated pace. The primitives that have survived—DEXs, collateralized lending, stablecoins—have proven their utility. Undercollateralized lending, particularly for institutions, has remained the elusive next frontier. With protocols like Wildcat, we are not just building another DeFi application but laying down foundational rails for a more mature, more integrated onchain financial system. The credit must and will flow. Wildcat’s contribution is to help direct that flow with greater clarity, precision, and purpose than before onchain. The rest, as always, will depend on the prudence and diligence of those who choose to participate.